The tax credit created in 2005 is one of the most important components of the federal government s support of solar energy and is available in all states even the ones with no state rebates or srecs 1.

Sunrun free solar panels state and federal rebates.

Starting in 2020 the value of the tax credit will step down to 26 and then again to 22 in 2021.

To help reach nevada s goal of 250 megawatts of installed solar capacity nv energy is offering the renewablegenerations solar rebate program or solargenerations to homeowners that go solar across the state.

Nevada wants to reward households for using renewable energy and maximizing energy efficiency.

Nv energy south renewablegenerations rebate.

In addition to rhode island s state solar incentives solar system owners are also eligible for the federal solar tax credit 10 if you buy your own solar system outright currently the federal solar tax credit gives you a dollar for dollar reduction against your federal income tax equal to 30 of the final cost of solar energy systems you install on your home.

The 30 tax credit applies as long as the home solar system is installed by december 31 2019.

Read on to learn what these payment plans really mean.

The 30 tax credit applies as long as the home solar system is installed by december 31 2019.

Starting in 2020 the value of the tax credit will step down to 26 and then again to 22 in 2021.

The short answer is yes.

But have no fear.

California solar tax incentives top the charts.

The 30 tax credit applies as long as the home solar system is installed by december 31 2019.

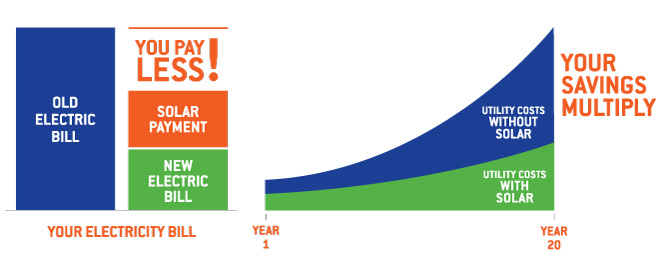

Leasing a home solar system is a lot like leasing a car.

While abundant sun is one of the best reasons to go solar in the sunshine state 1 it s also a good idea to learn about the other florida solar programs available to you.

1 the golden state is setting the gold standard for clean energy policy 2 with an ambitious goal to run on 100 carbon free energy by 2045.

The federal solar tax credit gives you a dollar for dollar reduction against your federal income tax.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

Thanks net energy metering tax exemptions and the federal solar tax credit owning a solar system and battery storage can help you gain energy independence and peace of mind.

1 solar state in the country.

With one of the sunniest climates in the world it s no surprise that california is the no.

The federal solar tax credit gives you a dollar for dollar reduction against your federal income tax.

Before we do that let s start with a crash course on what a solar lease is.

The federal solar tax credit gives you a dollar for dollar reduction against your federal income tax.

You get to use the solar panels but you don t.

Federal solar tax credit.